Steel Blue Boots Leather Work Boots

Get an Additional 20% OFF

PROMOCODE: GreatBoots

Featured products

Rag White T-Shirt w/ Print Box – 25lb.

Tool Bag Back Pack ProTech BucketBoss - HV

Business Source Copier Paper - 5pk

American Standard Champion 4 MAX Right Height Toilet

Niagara 0.5 Liter Bottled Purified Water

Spill Kit, Oil and Water, 65 Gallon w/ PPE for Two People

Flashlight Rechargeable Pelican - Yellow

ToughSystem 2.0 Rolling Tower

CAT Jobsite Tool Box Chest 36"

Pipe Wrench Heavy Duty Steel Reed - 12"

Shield Freeze Pops - Mixed (36ct)

20 Ton Hydraulic Gear Puller W/O Power Unit

Hand Pump 2 Speed, Single Acting, 67 Cu.In. Steel 10,000 PSI

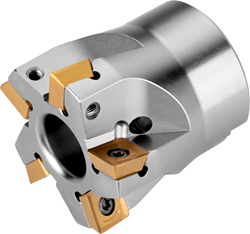

Shell Milling Cutter - Square Shoulder - 200A06R-IS90SO09-C

Milling Insert - Square Shoulder - LNGX 120504ER-M:M8340

Cosen C-260NC Fully Automatic Horizontal Scissor Style Band Saw

Bestsellers

Glove Nylon w/ Palm Nitrile Foam – L

Niagara 0.5 Liter Bottled Purified Water

Glove Nylon w/ Palm Nitrile Foam – XL

Battery Duracell – AA

Disposable Respirator w/ Elastic Straps

Oilfield Dry Moly Lube, 11 Wt Oz

Glove Nylon w/ Palm Nitrile Foam – M

Glove Cotton White w/ Dot Orange

Cross Buff Wheel 2-Ply 1”x3/8” Med

Safety Glasses Crews Bearkat Lens Clear

Brakleen Brake Parts Cleaner - Non-Chlorinated, 14 Wt Oz

Surface Conditioning Disc Type R 4” Standard – Coarse

Top Brands

News

Crude Tanker Hauling Russian Oil Sits for Days off UAE's Coast

An oil tanker hauling a cargo of Russian crude has been sitting off the coast of the United Arab Emirates for three days, raising the prospect that the gulf state might become customer for Moscow.

Biden Administration Misses Major Oil Lease Deadline

The Biden administration did not give an explanation after it missed its own deadline to plan future oil and gas lease sales Thursday.

Windfall Tax: How the North Sea is Churning Out Cash for Oil and Gas Barons

Bumper shareholder payouts, soaring profits, booming asset valuations: the oil and gas industry has bounced back from the depths of the pandemic with a vengeance.